How to Check Aadhar Card Link with PAN: A Simple Guide to Verify Your Identity

How to Check Aadhar Card Link with Pan: The deadline to link Aadhaar-PAN playing cards is rapidly drawing close. All PAN card holders must link their PAN cards with Aadhaar cards to make certain that their PAN card remains active. However, many may additionally have a doubt if its miles are already connected. Thus, we recommend you first test if your Aadhaar is related to your PAN card. The system to test if the Aadhaar is related to PAN is easy as supplied in the article beneath. If the Aadhaar isn’t always linked with the PAN card, you want to hyperlink it within 30 June 2023 via paying a penalty of Rs.1,000.

The government had made it obligatory for taxpayers to hyperlink their Aadhaar with their Permanent Account Number (PAN) playing cards on or before 30 June 2023. If taxpayers do now not link their Aadhaar with PAN playing cards, the PAN playing cards grow to be inoperative from 1 July 2023. Find out the procedure to check the Aadhaar-PAN card link repute online, offline, and through SMS.

Check the Aadhaar & PAN Card link status without logging into the Income Tax website.

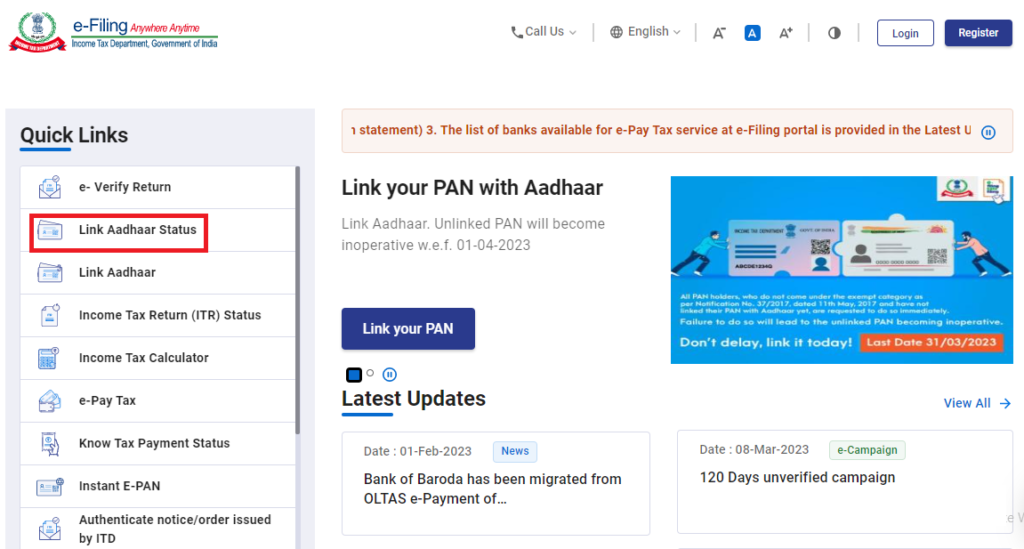

Step 1: Visit the Income Tax portal.

Step 2: Under the ‘Quick Links’ heading, click on the ‘Link Aadhaar Status’.

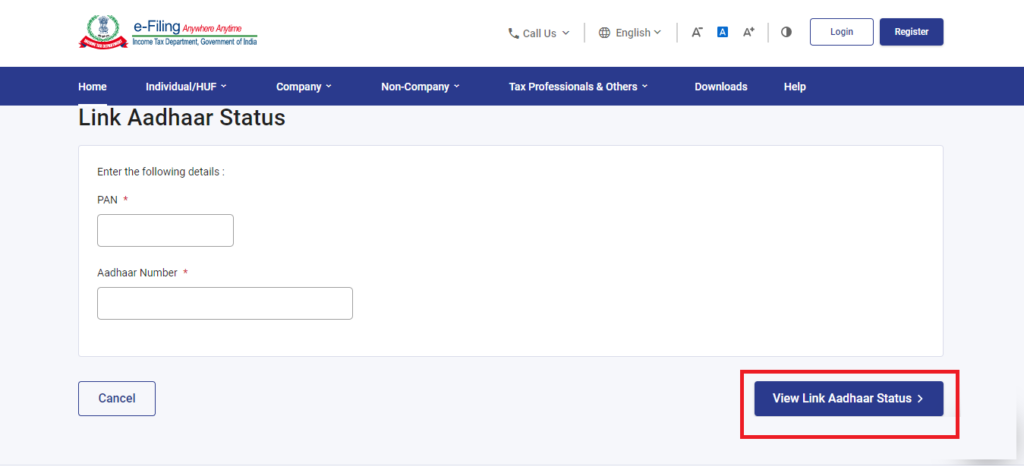

Step 3: Enter the ‘PAN variety’ and ‘Aadhaar Number’ and click on the ‘View Link Aadhaar Status’ button.

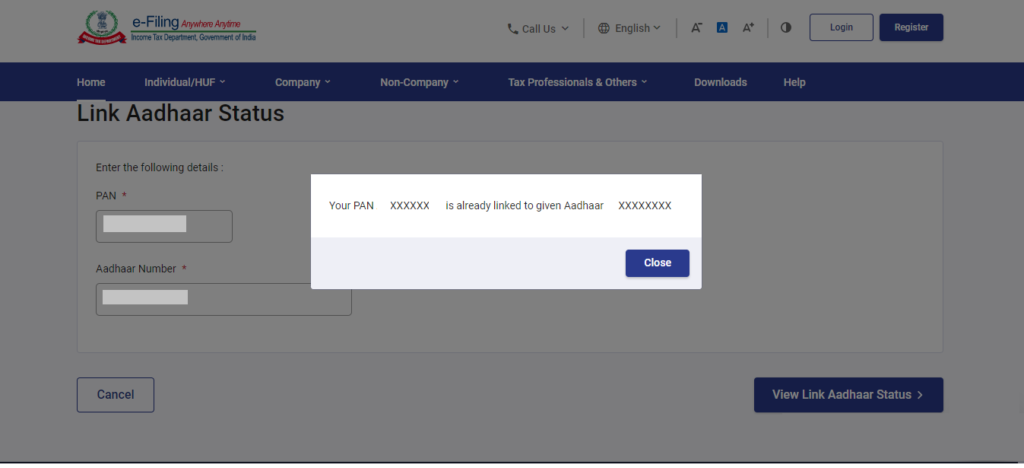

A message regarding your Link Aadhaar fame could be displayed on a hit validation. The following message can be displayed while your Aadhaar is connected to your PAN card: “Your PAN is already linked to the given Aadhaar” (as proven underneath).

When your Aadhaar-Pan link is in progress, the subsequent message will seem on the screen – “Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please take a look at the fame later by means of clicking on the ‘Link Aadhaar Status’ link on the Home Page.”

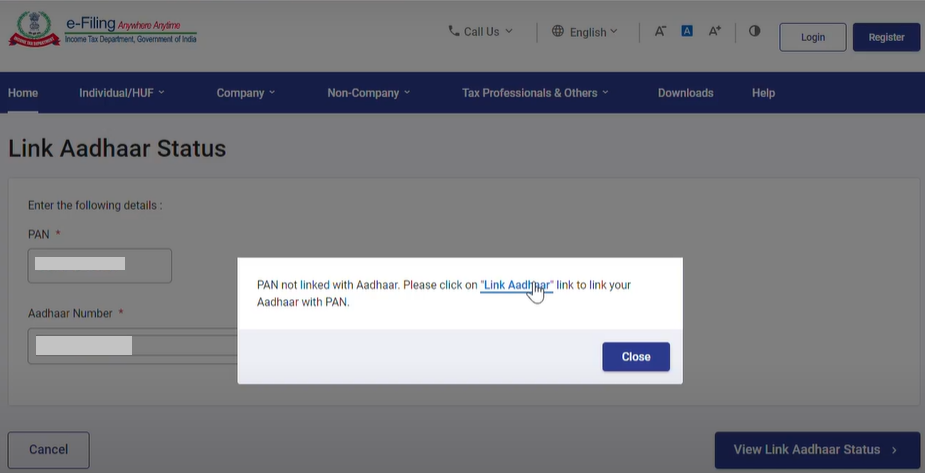

When your Aadhaar is not linked together with your Pan card, the subsequent message will seem at the display – “PAN no longer related with Aadhaar. Please click on ‘Link Aadhaar’ to hyperlink your Aadhaar with PAN” (as proven underneath).

Check the Aadhaar PAN card link reputation by means of logging into the Income Tax portal

Step 1: Login into the Income Tax e-submitting portal.

Step 2: Go to ‘Dashboard’ on the homepage and click on the ‘Link Aadhaar Status’ choice.

Step three: You can also visit ‘My Profile’ and click on the ‘Link Aadhaar Status’ choice.

When your Aadhaar is connected to your PAN card, the Aadhaar wide variety may be displayed. When your Aadhaar isn’t connected together with your PAN card, ‘Link Aadhaar Status’ will be displayed.

When your request to link your Aadhaar along with your PAN card is pending with the Unique Identification Authority of India (UIDAI) for validation, you’ll have to check the Status Bar later.

How To Check Aadhaar Card PAN Card Link Status through SMS?

Step 1: Write the following SMS – UIDPAN <12 digit Aadhaar range> < 10 digit PAN quantity>.

Step 2: Send the SMS to ‘567678’ or ‘56161’.

Step three: Wait for the reaction from the authorities carrier.

When Aadhaar is connected with PAN, the message will appear as follows – “Aadhaar is already associated with PAN in the ITD database. Thank you for the usage of our offerings.”

When Aadhaar isn’t related to PAN, the message will appear as follows – “Aadhaar isn’t related to PAN (quantity) in ITD database. Thank you for using our offerings.”

Fees for Aadhaar PAN Card Linking

The PAN-Aadhaar linking became free until 31 March 2022. If you related PAN-Aadhaar after 31 March 2022, however before 30 June 2022, a penalty of Rs.500 changed into imposed. However, after June 30, 2022, a penalty of Rs. 1,000 is imposed for linking a PAN with an Aadhaar card. Thus, you must first pay the penalty of Rs.1,000 to hyperlink your Aadhaar together with your PAN before 30 June 2023. When the PAN and Aadhaar cards aren’t linked earlier than 30 June 2023, PAN playing cards become inoperative from 1 July 2023.

Who Should Link Aadhaar with a PAN Card?

According to Section 139AA of the Income Tax Act, taxpayers with a PAN card have to link it to their Aadhaar cards. Thus, all taxpayers ought to mandatorily hyperlink their PAN with their Aadhaar cards by way of 30 June 2023 with the aid of paying the penalty of Rs.1,000 else their PAN playing cards turn inoperative.

However, Non-Residents Indians (NRIs), citizens elderly above eighty years, and citizens of Assam, Meghalaya, and Jammu and Kashmir want no longer hyperlink their Aadhaar with PAN playing cards since they come under the exempt category. Thus, check your Aadhaar-PAN hyperlink fame to find out in case your Aadhaar is connected together with your PAN card. If it isn’t always related, ensure to hyperlink it by means of 30 June 2023 to save your PAN card from being inoperative.