Income Tax 15G Form: Your Key to Tax Relief and Savings!

Income tax is a crucial aspect of every individual’s financial planning, and understanding various tax-saving provisions can help taxpayers legally minimize their tax liabilities. For non-salaried individuals, especially those with lower incomes, the Income Tax 15G form plays a vital role in seeking exemption from Tax Deducted at Source (TDS). In this blog post, we will delve into the details of the Income Tax 15G form, its eligibility criteria, and the process of its submission, empowering you to optimize your tax planning efficiently.

What is the Income Tax 15G Form?

The Income Tax 15G form is a declaration under Section 197A of the Income Tax Act, 1961, that allows individuals below a certain income threshold to avoid TDS deduction on certain interest income. The primary objective of this form is to provide relief to individuals, especially students, housewives, and senior citizens, who may not have a taxable income but earn interest on their savings or investments.

Eligibility Criteria for Filing Income Tax 15G Form:

Individual Status: Only individual taxpayers are eligible to submit Form 15G. Hindu Undivided Families (HUFs) and other entities are not eligible.

Age Limit: Individuals below the age of 60 years can file Form 15G, provided their total income for the financial year is below the basic exemption limit, which is currently Rs. 2.5 lakh.

Resident Status: The individual should be a resident of India as per the Income Tax Act.

Interest Income: Form 15G can be filed to seek TDS exemption on interest income from various sources like bank deposits, fixed deposits, recurring deposits, and other interest-earning investments.

Important Points to Consider:

Threshold Limit: As of the financial year 2021-22, an individual is eligible to submit Form 15G if their total income is below the basic exemption limit of Rs. 2.5 lakh. However, it is essential to verify the prevailing limits for each financial year as they may be subject to change.

Form 15H for Senior Citizens: Senior citizens above 60 years of age can file Form 15H instead of Form 15G to claim a TDS exemption on their interest income if they meet the eligibility criteria.

Multiple Declarations: Ensure that you submit Form 15G only if you genuinely meet the eligibility conditions. Providing incorrect information may attract penalties and consequences under the Income Tax Act.

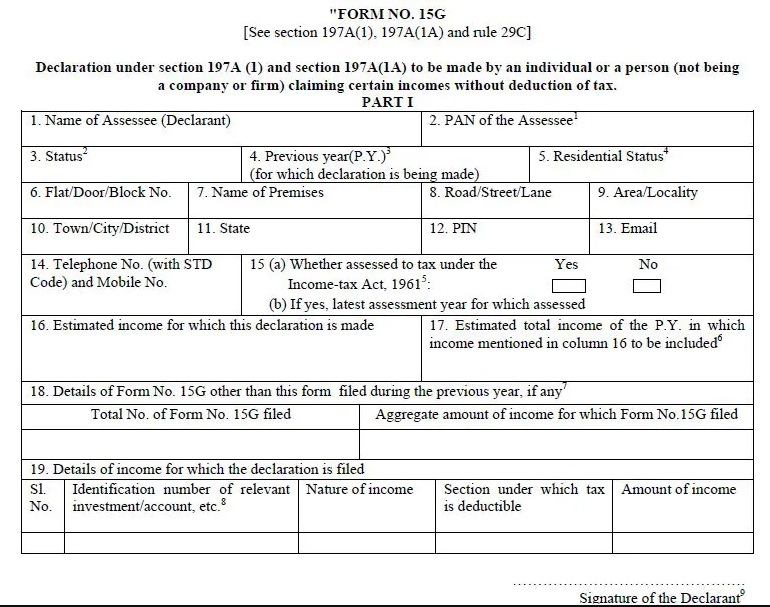

Step-by-Step Guide to Filling Form 15G

- New Form 15G has 2 parts/sections

Part 1

This section is to be filled by the man or woman (individual) who desires to claim certain ‘incomes’ without TDS.

Let us now undergo every point of Part-1 of Form no 15G.

1 – Name of the character who is making the assertion.

2 – PAN (Permanent Account Number) of the tax assessee. The statement is dealt with as invalid if a character fails to provide his / her legitimate PAN.

3 – Status – Declaration can be supplied through a man or woman or a man or woman (aside from a company or a firm).

4 – The monetary yr to which the stated earnings pertain.

5 – Residential reputation ie Resident Indian or NRI and so on.,

6 to 14 – Your Address & touch details.

15 (a) – Mention ‘Yes‘ if assessed to tax underneath the provisions of the Income-tax Act, 1961 for any of the assessment

year out of six evaluation years preceding the 12 months in which the announcement is filed.

15 (b) – Mention the cutting-edge Assessment Year for which Income Tax Return has been submitted and processed.

16 – Estimated earnings for which this announcement is made. (For EPF Withdrawal Enter the EPF amount you’ll acquire. This consists of only Employee and Employer contributions. This ought to no longer consist of EPS or Pension.)

17 – Estimated total profits of the P.Y. (Present / Financial Year) consisting of the income stated in factor no sixteen.

18 – In case any statement(s) in Form No. 15G is filed earlier than filing the brand new statement at some point of the Financial year, you have to mention the total wide variety of such Form No. 15G filed alongside the mixture amount of profits for which stated declaration(s) have been filed.

19 – Mention the distinct variety of shares, account for the quantity of time period deposit, habitual deposit, National Savings Schemes, existence coverage policy quantity, employee code, and so forth.,

Part 2

This section is to be filled by the individual/organization responsible for paying the profits. An example can be a bank that will pay ‘interest earnings’ on a depositor’s Fixed deposit.

Difference Between Form 15G and Form 15H

Form 15G and Form 15H are both declaration forms under Section 197A of the Income Tax Act, 1961, used to seek exemption from Tax Deducted at Source (TDS) on certain interest income. However, there are key differences between the two forms, primarily based on the age and income criteria of the individual taxpayers. Let’s explore the differences between Form 15G and Form 15H:

- Age Criteria:

Form 15G: This form can be filed by individuals who are below 60 years of age.

Form 15H: This form is specifically for senior citizens aged 60 years and above.

- Eligibility Criteria:

Form 15G: Individuals below the age of 60 years can submit Form 15G if their total income for the financial year is below the basic exemption limit (currently Rs. 2.5 lacks). They should also meet certain other conditions to be eligible.

Form 15H: Senior citizens above the age of 60 years can file Form 15H to claim TDS exemption on their interest income, provided they meet the eligibility criteria, which includes having no tax liability after considering available deductions.

- Income Threshold:

Form 15G: The individual’s total income for the financial year should be below the basic exemption limit (currently Rs. 2.5 lacks) to be eligible for Form 15G.

Form 15H: There is no specific income threshold for senior citizens filing Form 15H. They can submit the form if their tax liability is nil after considering available deductions.

- Tax Liability:

Form 15G: Individuals filing Form 15G should have no tax liability for the financial year to be eligible for TDS exemption.

Form 15H: Senior citizens filing Form 15H should not have any tax payable on their total income after availing deductions like Section 80C, 80D, etc.

- Applicability to Different Types of Income:

Form 15G: This form can be used to seek TDS exemption on interest income from various sources like bank deposits, fixed deposits, recurring deposits, etc.

Form 15H: Similar to Form 15G, Form 15H can be used to claim TDS exemption on interest income, but it is specifically for senior citizens.

It’s essential to ensure that the appropriate form is filed based on the individual’s age and income criteria to avoid any discrepancies in TDS deductions. Both Form 15G and Form 15H provide a means for eligible taxpayers to reduce their tax burdens legally and effectively, depending on their age and financial situation.

Conclusion:

The Income Tax 15G form serves as a valuable tool for non-salaried individuals to seek exemption from TDS on interest income. By carefully understanding the eligibility criteria and adhering to the correct procedures, taxpayers can maximize their tax savings and manage their finances more efficiently. Remember to review the prevailing income thresholds each financial year and ensure accurate information while filing the form. Proper utilization of Form 15G can significantly benefit students, housewives, and senior citizens, offering them a means to reduce their tax burdens legally and effectively. Always consult with a tax professional for personalized advice and comprehensive tax planning strategies.