How to File Nil GST Return: A Simple Step-by-Step Guide

How to File Nil GST Return: Goods and Services Tax (GST) is a tax levied on the supply of goods and services in India. All registered taxpayers are required to file a GST return to report their sales, purchases, and tax liability. However, if there is no business activity during a particular period, a Nil GST Return must be filed. A Nil GST Return is a return filed by a registered taxpayer who has not made any outward supplies or inward purchases during a specific period. In this blog post, we will discuss everything you need to know about filing a Nil GST Return.

Who needs to file Nil GST Return?

Registered taxpayers under GST who have not made any outward supplies or inward purchases during a particular period are required to file a Nil GST Return. This applies to all types of taxpayers, including regular taxpayers, composition taxpayers, and taxpayers registered under the GST system for non-resident taxpayers. Therefore, if you are a registered taxpayer under GST and have not made any business transactions during a specific period, you must file a Nil GST Return to comply with GST regulations. It is essential to file a Nil Return even if there is no business activity to avoid any penalty or legal repercussions.

Step-by-Step Guide to Filing Nil GST Return

Filing a Nil GST Return is a simple and straightforward process that can be done online through the GST portal. Here’s a step-by-step guide to filing Nil GST Return:

Step 1: Log in to GST Portal

The first step is to log in to the GST portal using your registered credentials, such as username and password.

Step 2: Navigate to the Returns Dashboard

Once you have logged in, click on the ‘Returns Dashboard’ under the ‘Services’ tab on the homepage.

Step 3: Select the Applicable Return

From the Returns Dashboard, select the appropriate return for which you want to file a Nil Return. For example, if you are filing a Nil Return for the monthly return, select GSTR-3B, or if you are filing a Nil Return for the quarterly return, select GSTR-1.

Step 4: Declare Nil Return

In the Nil GST Return section, click on the ‘Nil Return’ checkbox and select the relevant financial year and the tax period for which you want to file a Nil Return.

Step 5: Submit the Return

After filling in the details, click on the ‘Preview’ button to review the details you have entered. If there are no errors, click on the ‘File Nil Return’ button to submit the Nil GST Return.

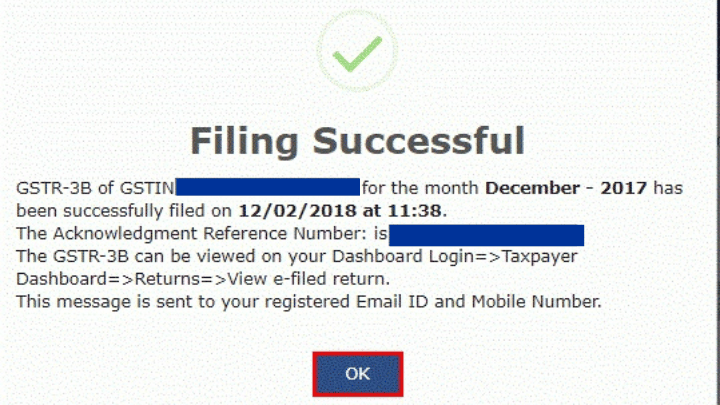

Step 6: Acknowledgment of Return

Once you have submitted the Nil GST Return, an acknowledgement receipt with a unique reference number will be generated. This acknowledgement receipt serves as proof of filing a Nil GST Return.

In conclusion, filing a Nil GST Return is an important compliance requirement under GST regulations. By following the steps mentioned above, you can easily file a Nil GST Return online and avoid any penalty or legal repercussions.

Common Errors to Avoid while Filing Nil GST Return

While filing a Nil GST Return, it is crucial to avoid common errors that can lead to rejection or penalties. Here are some common errors that taxpayers should avoid while filing Nil GST Returns:

Not Filing a Nil GST Return: The most common error is not filing a Nil GST Return. Even if there is no business activity during a particular period, it is mandatory to file a Nil GST Return to comply with GST regulations.

Incorrect Tax Period: Taxpayers should ensure that they select the correct tax period while filing a Nil GST Return. Selecting the wrong tax period can lead to rejection of the return.

Non-filing of Previous Returns: Taxpayers must ensure that they have filed their previous GST returns before filing a Nil GST Return. Failing to file previous returns can lead to penalties and legal repercussions.

Incorrect Details: Taxpayers must ensure that they enter accurate and correct details while filing a Nil GST Return. Entering incorrect details can lead to rejection of the return.

Late Filing: Filing a Nil GST Return after the due date can lead to late fees and penalties. Taxpayers should ensure that they file their Nil GST Return within the due date to avoid such fees.

Incorrect Declaration: Taxpayers must ensure that they select the correct option for Nil Return. Choosing the wrong option can lead to rejection of the return.

Benefits of Filing Nil GST Return

Filing a Nil GST Return, even when there is no business activity during a particular period, can provide various benefits to taxpayers. Here are some of the benefits of filing a Nil GST Return:

Compliance with GST Regulations: Filing a Nil GST Return is mandatory under GST regulations. By filing a Nil GST Return, taxpayers can ensure that they are complying with the GST regulations, even when there is no business activity.

Avoidance of Penalties: Failing to file a Nil GST Return can lead to penalties and legal repercussions. By filing a Nil GST Return on time, taxpayers can avoid such penalties and maintain a good compliance record.

Easy Future Returns: By filing a Nil GST Return, taxpayers can avoid the accumulation of any pending GST returns. This can make the process of filing future returns more manageable and easier.

Enhanced Business Credibility: Filing a Nil GST Return on time can enhance the credibility of the business. This can help in building trust among customers, suppliers, and financial institutions.

Faster Processing of Refunds: In case a taxpayer has a refund claim, filing a Nil GST Return can help in faster processing of such claims. By having a clean compliance record, taxpayers can avoid any unnecessary scrutiny from tax authorities.

Conclusion

Filing a Nil GST Return is an important compliance requirement under GST regulations. It is mandatory for all GST registered taxpayers, even if there is no business activity during a particular period. By following the step-by-step guide mentioned in this article, taxpayers can easily file a Nil GST Return online and avoid any penalty or legal repercussions.

While filing a Nil GST Return, taxpayers should avoid common errors such as selecting the wrong tax period, entering incorrect details, or filing the return after the due date. Filing a Nil GST Return can provide various benefits, including compliance with GST regulations, avoidance of penalties, easy future returns, enhanced business credibility, and faster processing of refunds.

By maintaining a good compliance record and timely filing of Nil GST Returns, taxpayers can build trust among customers, suppliers, and financial institutions. Filing a Nil GST Return is not only a legal requirement but also an essential part of running a business in a responsible and compliant manner.