GST State Code List Pdf | Numbers That Matter

GST State Code List PDF: Understanding the goods and services tax is crucial for businesses that want to run smoothly in India. The State Code List is the foundation of the GST system. It’s a collection of codes that are simple but extremely important. We’re going to introduce and explain the GST State Code List PDF in this blog. Businesses can start to understand what the GST State Code List PDF is all about.

In our latest blog, we take you on a journey to help you understand India’s taxation system. The GST State Code List PDF is something that you may not have given much thought to. This two-digit code will be explained in simple language to help you understand how it can improve your business’ accuracy and compliance with the rules. Learn how to take control of your business and the constantly changing world of Indian taxation.

Discover our easy-to-understand guide on the GST State Code List PDF, a crucial piece in the puzzle of India’s tax rules. Come with us as we explain the importance of this digital document, showing you how it can help your business. Dive into the details and boost your understanding of tax compliance.

What is the GST state code?

The GST state code is two digits from the GSTIN, a 15-digit alphanumeric code that taxpayers receive upon successful registration. This code varies for each Indian state.

When you register a business with GST, you will be given a temporary state code for seven days. A permanent state code is then assigned to you. The GST state code will be displayed on all invoices that you receive or submit.

As an example, the 10 GST State Code in 03AAJCR2207E1Z2 represents GST-registered businesses in Punjab. Here are some other examples.

- GST state code 15 is for Mizoram

- GST state code 07 represents Delhi

- GST state code 11 is for Sikkim.

- Karnataka GST State Code is 29

- GST state code 23 represents Madhya Pradesh

State codes are used to identify the location of a business or its headquarters. GST law requires that businesses in different states or regions register under the same state code. Check out the list of GST state codes below.

List GST State Codes

This is a list with the respective GST codes for each state and union territory

| States | GST State Code | Alpha Code |

| Himachal Pradesh | 02 | HP |

| Punjab | 03 | PB |

| Chandigarh | 04 | CH |

| Uttarakhand | 05 | UA |

| Haryana | 06 | HR |

| Delhi | 07 | DL |

| Rajasthan | 08 | RJ |

| Uttar Pradesh | 09 | UP |

| Bihar | 10 | BR |

| Sikkim | 11 | SK |

| Arunanchal Pradesh | 12 | AP |

| Nagaland | 13 | NL |

| Manipur | 14 | MN |

| Mizoram | 15 | MZ |

| Tripura | 16 | TR |

| Meghalaya | 17 | ML |

| Assam | 18 | AS |

| West Bengal | 19 | WB |

| Jharkhand | 20 | JH |

| Odisha | 21 | OR |

| Chattisgarh | 22 | CG |

| Madhya Pradesh | 23 | MP |

| Gujarat | 24 | GJ |

| Dadra and Nagar Haveli, Daman And Diu | 26 | DD, DN |

| Maharashtra | 27 | MH |

| Andhra Pradesh | 28 | AP |

| Karnataka | 29 | KA |

| Goa | 30 | GA |

| Lakshadweep | 31 | LD |

| Kerela | 32 | KL |

| Tamil Nadu | 33 | TN |

| Puducherry | 34 | PY |

| Andaman and Nicobar Islands | 35 | AN |

| Telangana | 36 | TS |

| Andhra Pradesh | 37 | AP |

| Ladakh | 38 | LA |

| Other Territory | 97 | OT |

The Objectives of GST State Code

- The GST Code is used by the government to determine if IGST, SGST, or CGST will be applied to a business or taxpayer.

- The state code of GST can be obtained by using the buyer’s Goods & Services Tax Identification number, which is found in the “Place of Supply” section of the GST bill.

- If the state codes of both the customer and supplier are different, the IGST will be charged.

- If the codes of the two states are identical, both the SGST (State GST) and CGST (Cost-Gross-State Tax) are applied.

- The code list is used by the taxpayer to register for GST and to enter invoice data in GST returns.

Read This Also: How to Get GST Number

Where do we need the state code in GST?

GST state codes are used widely in GST compliance, adjudication, and enforcement. GST is important primarily for these reasons:

1. GST Registration

The applicant must provide accurate and complete details to obtain a valid GST registration. The officer verifies that the information provided by the taxpayer is accurate and complete. A GSTIN, which includes the GST state code, is then assigned to the applicant.

2. GST Invoices and electronic Invoices

GST requires the GST state code to be used for accurate invoicing. Valid GSTINs for the buyer, the seller, and the consignee contain the state codes that are used to identify where the sale took place. The place of supply will determine the type of GST that is charged, depending on whether it’s an intrastate or interstate sale.

3. Return Reporting GSTR-1 and 3B

Regular taxpayers are required to include details of B2B invoices, including GSTINs, in their GSTR-1 or IFF monthly or quarterly. These details are sent to buyers’ GSTR-2A/GSTR-2B based on GSTIN.

Where do you need GST jurisdiction?

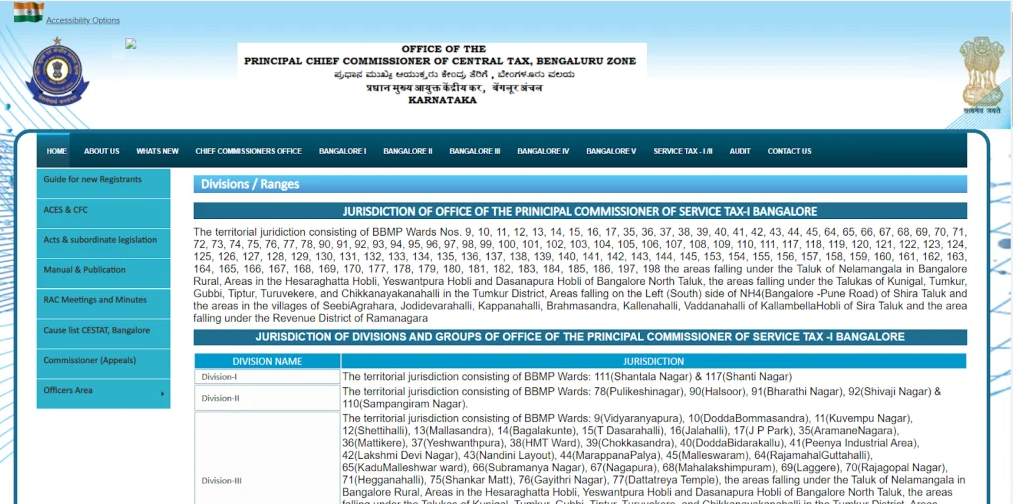

For processing tax returns, the Indian government has established GST jurisdictions. The GST jurisdictions differ for each geographical region and PIN code. Taxpayers must register their business under a particular jurisdiction based on its location.

The Central Board of Indirect Taxes and Customs (CBITC) allows taxpayers registered on the CBITC portal to check their jurisdiction.

In the event of a dispute, businesses can contact their jurisdictional officer. These jurisdictions can be classified as central or state jurisdictions.

Read This Also: Why Should You Hire a Tax Consultant

Classifications of GST Jurisdictions

In CGST Circular No. 21/2017, dated September 20, 2017, it is stated that central and state jurisdictions are to be governed as follows:

- 90% of taxpayers who have a turnover of less than Rs. 1.5 crore fall under the state administration, while the remaining 10% are under the central administration.

- The state administers 50% of the taxpayers who have a turnover above Rs. 1.5 crore, while the Centre is responsible for the other 50%.

For hassle-free and convenient registration, GST jurisdictions have been classified according to their geographical location, size, and hierarchy. The GST jurisdiction classification is as follows:

- The Zone

- Commissionerates

- Range Offices

- Division Offices

How to find the GST jurisdiction?

Before registering for GST, the taxpayer might be asked to determine the state jurisdiction. Taxpayers can search for the state jurisdiction of a department by searching the wards and circles on the website for the state VAT, sales tax, or commercial tax.

You can find the website by searching for ‘Karnataka GST jurisdiction’ in your web browser. We can find the website by searching for ‘Karnataka GST jurisdiction’ in the web browser at http://gstkarnataka.gov.in/Jurisdiction.html.

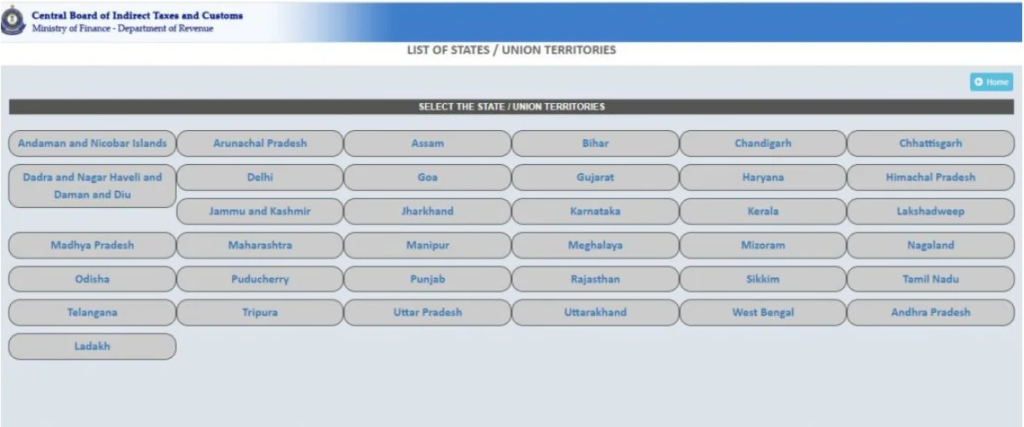

The CBIC has a dedicated website to search for the central jurisdiction called “Know Your Jurisdiction,” which is accessible via any browser at the following URL: The CBIC dedicated website to search for the Central jurisdiction, called “Know your Jurisdiction,” is accessible via any browser at the following URL:https://cbic-gst.gov.in/cbec-portal-ui/?knowYourJuris

- Select your state or union territory from the list on the screen

- Click on the zone to select it.

- A list of commissions will be displayed on your screen after you select a zone. Click on the rate of commission that you are interested in.

- The screen will then display a list of sub-commissions and divisions. Select the appropriate sub-commission or division.

- You will receive a list with the boundaries of your jurisdiction. Here, you can find more information on the jurisdictions that apply to your business.

Source: navi.com

Final Word

Taxpayers can easily and transparently collect GST by using the state code and jurisdiction. Businesses must know the GST State Code to successfully process invoices. The GSTIN code is necessary for individual taxpayers. It is proof that the transaction has been made with a registered institution.

Watch This Also on YouTube